Markets

Wärtsilä focuses on the marine and energy markets with products, solutions, and services. Our target markets are sensitive to business cycles. However, this is offset by the somewhat different business cycles in the various market segments. Wärtsilä’s manufacturing model brings flexibility to both manufacturing and cost structure through outsourcing and supports profitability independently of the business cycle.

Marine markets in 2025

The marine market in 2025 was impacted by geopolitical tensions, shifting trade patterns, and the IMO decision to delay the adoption of global carbon pricing mechanism. The announced tariff policies, the growing national interests in shipbuilding, concerns on security of supply, and the disruptions to critical shipping routes have led to increasing uncertainty, especially among shipowners. Market sentiment remained on a good level. The uncertainty caused by the tariff policies eased towards the end of the year, along with a truce to hostilities being established in the war in the Middle East, raised the prospects of more widespread use of the Suez canal. In October, the vote to adopt the IMO’s Net Zero Framework was postponed by one year. This outcome opens the door to a fragmented landscape of carbon pricing mechanisms being introduced by individual regions and countries.

Ordering eased across most segments compared to the extraordinary activity seen in 2024, but activity was seen to pick up especially in Q4. Meanwhile, ordering has continued to be strong in some segments, notably containerships, cruise vessels, and LNG bunkering ships. In total, 2,029 newbuild contracts were reported in January-December, compared to 2,386 contracts reported in 2024, excluding late reporting of contracts. A total of 366 orders for new alternative fuel capable ships were reported in January-December, accounting for 18% (27) of all contracted vessels and 37% (50) of the capacity of contracted vessels.

With moderating ordering volumes, increasing shipyard capacity and high delivery output, average newbuild ship prices declined modestly throughout the year. Despite this, the shipyards’ forward cover remains largely unchanged at 3.9 years globally, the highest level since 2009.

In the cruise segment, market sentiment continues to be positive, driven by growth in demand for cruises. This momentum has enabled cruise operators to firm up plans for acquiring additional ship capacity to support their long-term expansion objectives. Additionally, service demand is being bolstered by the growth in active fleet capacity, interest in efficiency enhancements required for regulatory compliance, and efforts to reduce operational costs.

In the ferry segment, market sentiment remained positive with fleet renewal being the key driver for solid newbuild activity in 2025. However, high newbuild prices and limited yard slots continued to limit the near-term investment appetite for newbuilds. The demand for service was supported by improving fleet utilisation rates, and operator interest in maintaining and improving the efficiency of their ageing fleets.

In the offshore segment, capex commitments to oil & gas projects picked up in late 2025, supporting the demand especially for mobile oil and gas production units. This uptick indicates that oil companies have moved past some of the earlier uncertainty. Newbuild activity continued to be limited by high prices, the availability of finance, a shortage of yard capacity, and moderating day rates. Sentiment in the offshore wind sector was impacted by uncertainty in political support across countries, as well as by ongoing cost pressures impacting investor confidence. This has resulted in project delays and a more limited interest in newbuilds. The demand for service across both offshore sub-segments was driven by relatively high asset utilisation rates.

In the LNG carrier segment, market conditions were challenging despite a seasonal uptick in Q4. Increased short-haul trade constrained demand for ships, while strong fleet capacity growth continued, putting significant pressure on spot and utilisation rates for mostly the older ships. Newbuild activity has moderated significantly from prior years, due to strong orderbooks and delays to LNG export projects. Newbuild ordering for LNG bunkering vessels reached a new annual record as the current fleet capacity struggles to keep pace with the increase in use of LNG as fuel. The demand for service was negatively affected by the higher idling of ships, and by owners seeking to cut costs in adverse market conditions.

In the containership segment, market sentiment remained mixed and uncertain. Freight market conditions continued to soften, while the timecharter market was more balanced. Geopolitics and the Red Sea rerouting remain key sources of uncertainty to the demand outlook for containerships. Despite this, the investment appetite for newbuilds remained very strong as liner operators and tonnage providers have progressed with their fleet renewal plans. The high uncertainty over demand for ship capacity affected demand for service, but overall service demand remained healthy and was supported by high ship utilisation rates.

Energy markets in 2025

The global energy transition continues to move forward despite certain countries having a reduced climate ambition. Most research agencies, such as IEA and BloombergNEF, have kept their global forecasts for wind and solar similar to previous levels, highlighting continued short- and long-term growth and annual capacity additions of hundreds of gigawatts. Favourable economics shield wind and solar from changes in policy, while at the same time, in most countries, policies continue to be supportive of renewables.

Two key themes stood out in energy-related macroeconomic development in 2025: load growth and tariff-related uncertainty. Accelerated load growth from the electrification of industry, transport, and heating, as well as from data centre investments, have led to high demand for all power-producing assets, including gas-fuelled power. The uncertain tariff and regulatory situation poses challenges to all actors due to its impact on global energy technology supply chains, and is expected to continue in 2026. This situation has led to longer delivery times, and industry participants have responded by expanding manufacturing capacity.

The investment environment for energy technologies has improved along with global macroeconomic conditions. During 2025, global natural gas and LNG prices decreased. Prices are expected to somewhat decrease in the second half of the decade due to increased supply, and volatility has also decreased. Prices for lithium rebounded slightly after hitting a four-year low during the summer.

In engine power plants, the market demand for equipment and services has been strong. In the balancing segment, the pace of the renewable energy transition continued to be an important demand driver. The total market for thermal balancing in 2025 is expected to be larger than in any previous year, based on data from both McCoy Power Reports and that gathered internally. The drivers for balancing demand are also expected to continue to develop favourably. For example, BloombergNEF expects wind and solar capacity addition projects to grow towards 2035, while supportive market reforms are developing, and old, inflexible coal and gas plants are being retired. The baseload segment remains a consistent source of demand for thermal power. Reciprocating engines are important providers of baseload generation, particularly in remote locations and other locations where access to grid power is uncertain or time sensitive.

Demand for baseload generation is expected to remain stable, with further growth opportunities in data centres. The data centre power landscape is undergoing a significant transformation. Rapid growth in high-tech industries and AI applications is driving unprecedented energy demand, making reliable on-site power essential.

In battery energy storage, demand is closely linked to the increasing share of intermittent renewables in the energy system, which continues to progress strongly. The annual market for utility-scale battery storage is expected to have surpassed 200 GWh in 2025, and is expected to exceed 400 GWh before the end of the decade, according to BloombergNEF. The US market is facing regulatory headwinds, though several drivers remain solid, with data centres as a potential new opportunity. Globally, competition has tightened as battery manufacturers, for example, have expanded downstream, putting pressure on profitability.

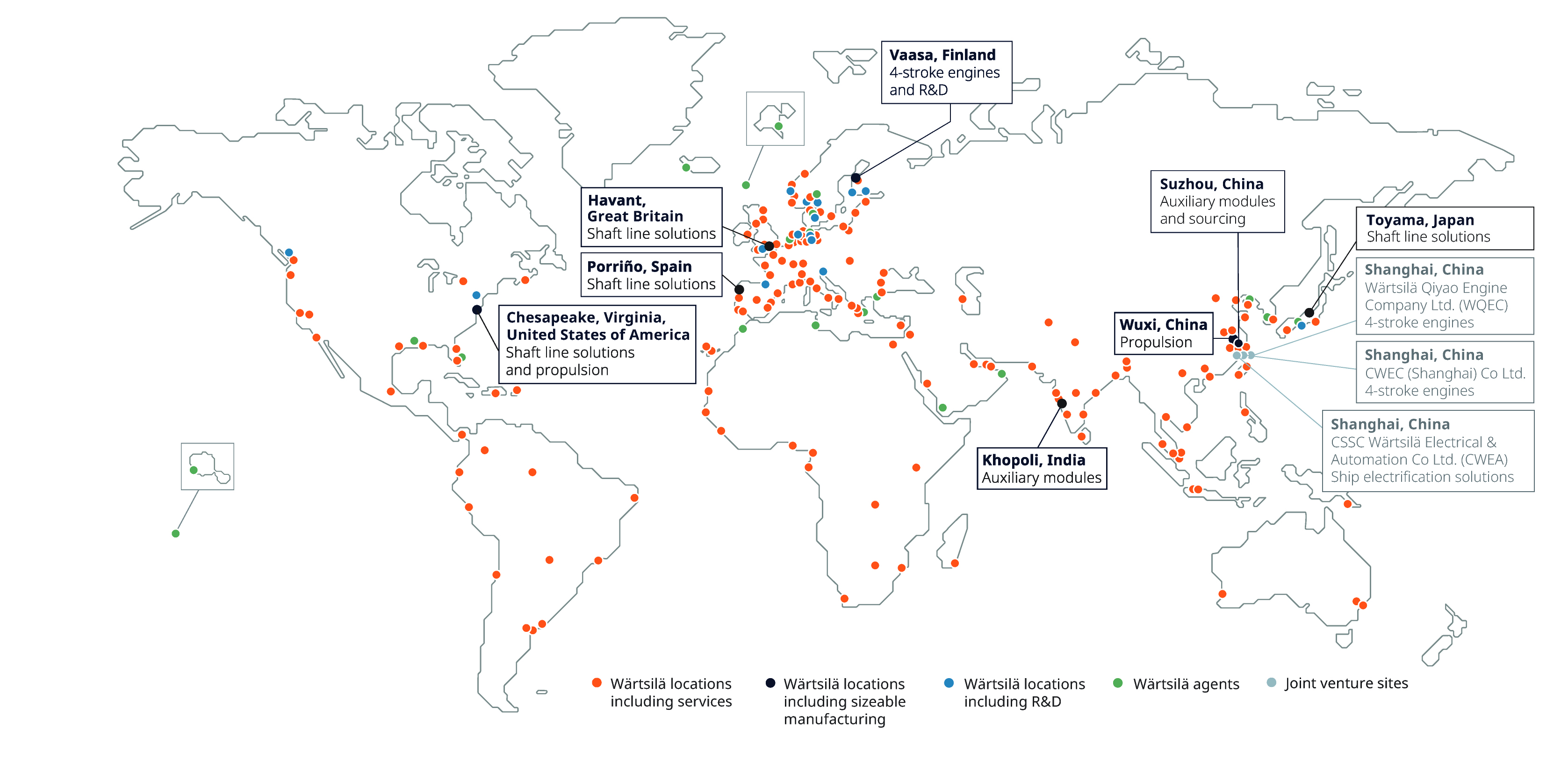

Wärtsiläs global reach

Wärtsilä is a global leader in innovative technologies and lifecycle solutions for the marine and energy markets. To support our geographically dispersed customer base, Wärtsilä’s sales and service network covers 199 locations in 78 countries worldwide. With over 190 years of experience, emphasising the importance of developing long-term relationships, we partner with subsidiaries, joint ventures, and a global network of suppliers