Credit information and maturity profile

Key credit figures

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|---|---|

Return on equity (ROE), % | 21.3 | 12.3 | -2.6 | 8.6 | 5.8 | 9.0 |

Net interest-bearing loan capital | -777 | 35 | 481 | 4 | 394 | 726 |

Gearing | -0.31 | 0.02 | 0.23 | 0.00 | 0.18 | 0.30 |

Solvency, % | 37.4 | 37.0 | 35.3 | 38.6 | 38.1 | 40.8 |

Credit programmes

The information below is from the Financial Statements Bulletin 2024 published on 5 February 2025.

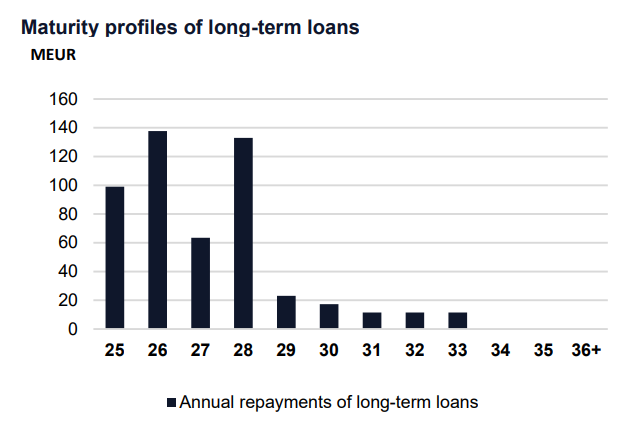

Wärtsilä’s net interest-bearing debt totalled EUR -777 million at the end of the period (35). The total amount of short-term debt maturing within the next 12 months is EUR 142 million. Long-term debt amounted to EUR 624 million.

Gearing was -0.31 (0.02), while the solvency ratio was 37.4% (37.0%). Equity per share was EUR 4.29 (3.78).

Ratings

Wärtsilä has not issued bonds to the market and thus has never had a company rating available or analyst coverage for debt instruments.

Maturity profile

Interest bearing loan capital

| 2024 | 2023 | |

|---|---|---|

| Non-current liabilities | 409 | 515 |

| Current liabilities | 99 | 76 |

| Loan receivables | -4 | 1 |

| Cash and cash equivalents | 1,557 | 819 |

| Net | -777 | 35 |