Credit information and maturity profile

Key credit figures

| 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | |

|---|---|---|---|---|---|---|

Return on equity (ROE), % | 23.3 | 21.3 | 12.3 | -2.6 | 8.6 | 5.8 |

Net interest-bearing loan capital | -2,006 | -777 | 35 | 481 | 4 | 394 |

Gearing | -0.70 | -0.31 | 0.02 | 0.23 | 0.00 | 0.18 |

Solvency, % | 40.5 | 37.4 | 37.0 | 35.3 | 38.6 | 38.1 |

Credit programmes

The information below is from the Financial Statements Bulletin 2025 published on 4 February 2026.

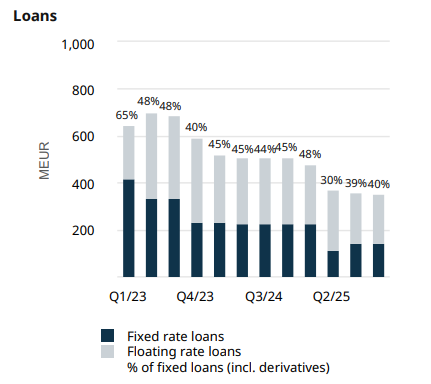

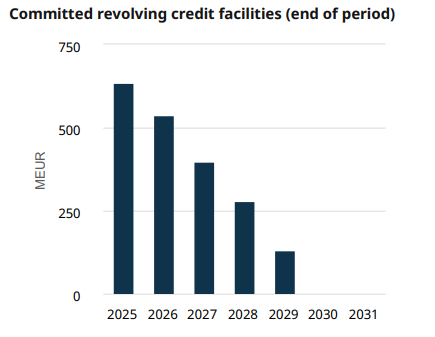

Wärtsilä had interest-bearing debt totalling EUR 581 million at the end of the year (766). The total amount of short-term debt maturing within the next 12 months was EUR 38 million. Long-term loans amounted to EUR 315 million. Additionally, EUR 4 million of interest-bearing liabilities pertained to assets held for sale (15).

Net interest-bearing debt totalled EUR -2,006 million (-777). Gearing was -0.70 (-0.31), while the solvency ratio was 40.5% (37.4). Equity per share was EUR 4.89 (4.29)

Ratings

Wärtsilä has not issued bonds to the market and thus has never had a company rating available or analyst coverage for debt instruments.

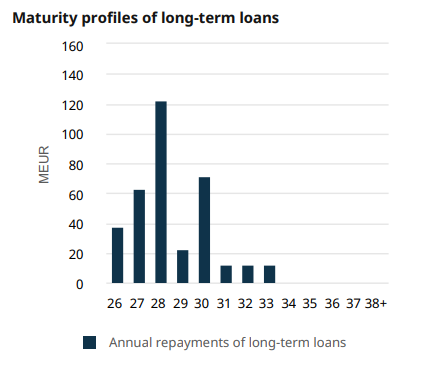

Maturity profile

Interest bearing loan capital

| 2025 | 2024 | |

|---|---|---|

| Long-term loans | 315 | 409 |

| Short-term loans | 38 | 99 |

| Loan receivables | 0 | -4 |

| Cash and cash equivalents | 2,590 | 1,557 |

| Net | -2,006 | -777 |