We hosted an investor theme call focusing on Wärtsilä’s data centre opportunities, featuring CEO Håkan Agnevall and President, Wärtsilä Energy, Anders Lindberg on 12 February 2026. The session provided an in-depth overview of market developments, technology competitiveness, and Wärtsilä’s positioning in the rapidly evolving data centre power segment. No new material information was disclosed during the call. The recording of the call is available here, and the presentation slides are available here.

The call opened with a review of the expanding power demand driven by AI and digitalisation. Over the past two years, data centre requirements have moved from traditional storage-oriented facilities to large-scale compute clusters needing hundreds of megawatts of power. This change has opened a new opportunity for Wärtsilä, particularly in markets where grid access is constrained and developers need fast, reliable off-grid or behind-the-meter solutions.

Wärtsilä entered the data centre power market only recently but has already seen rapid traction. In 2025, the company secured close to 800 MW of orders related to data centre applications. Early 2026 brought an additional 429 MW order from a US utility building a plant dedicated to data centre load. While the US currently offers the largest opportunity, similar developments are emerging in Europe, the Middle East, and Asia at varying speeds.

The emerging sweet spot for engine-based power

There is high demand for new, off-grid data centre power in the 50-400 MW size range, and even larger projects are often built in phases, offering Wärtsilä an attractive market opportunity in its natural sweet spot for cost-competitive engine power plants. Although some projects exceed this range, engine technology remains attractive due to modularity, high part-load efficiency, and the ability to maintain performance even in hot climates.

As AI workloads expand, the long-term picture is not limited to immediate energy needs. Once grid connections eventually materialise, modular engine plants can evolve into flexible assets supplying both the data centre and the wider grid. This flexibility also supports customers’ decarbonisation roadmaps, especially as more and more renewables are integrated to the power generation mix.

In the data centre value chain, Wärtsilä primarily engages with developers, IPPs, and utilities. As data centre development accelerates, this ecosystem is becoming increasingly dynamic, and Wärtsilä’s established relationships with utilities and IPPs, combined with new partnerships with data centre-focused developers, position the company well for continued growth.

Structurally growing demand and an expanding pipeline

Industry forecasts for US data centre power needs vary widely, ranging from 40 GW to over 110 GW over the coming decade, but all point to robust growth. Instead of being driven by consumer applications, customers emphasise corporate AI adoption as the primary long-term demand driver.

Wärtsilä’s own pipeline has expanded by roughly 50% over the past six months. Activity remains high, particularly in the off-grid segment where speed to power is critical and equipment supply globally is constrained. Deliveries for the recently secured orders will begin ramping up in 2027, with service revenues expected to follow later due to commissioning timelines and warranty periods.

Technology advantages supporting competitiveness

The presentation from Håkan and Anders highlighted several intrinsic advantages of Wärtsilä’s medium-speed engines in data centre applications:

- High efficiency at full and part load

- Unlimited starts and stops and fast ramping capability

- Modular design enabling optimal plant sizing

- Strong performance in hot climates and high altitudes

- Minimal water usage due to closed-loop cooling

- High reliability and fuel flexibility, including hydrogen blends up to 25% today

When comparing technologies at the 300 MW scale, Wärtsilä’s modular approach requires far less additional installed capacity to meet the stringent availability requirements of data centres. This translates into more attractive CapEx and lifetime cost of energy relative to aeroderivative and combined-cycle gas turbines.

Current market constraints have extended lead times for many technologies. Under normal conditions, engines already offer shorter timelines from order to commissioning compared with turbines, and in today’s tight supply environment the difference is even more pronounced.

Wärtsilä’s global service network further strengthens the position, offering comprehensive lifecycle solutions from parts supply to full optimised maintenance agreements and services. Given the criticality of uptime and security in data centre operations, this capability resonates strongly with customers.

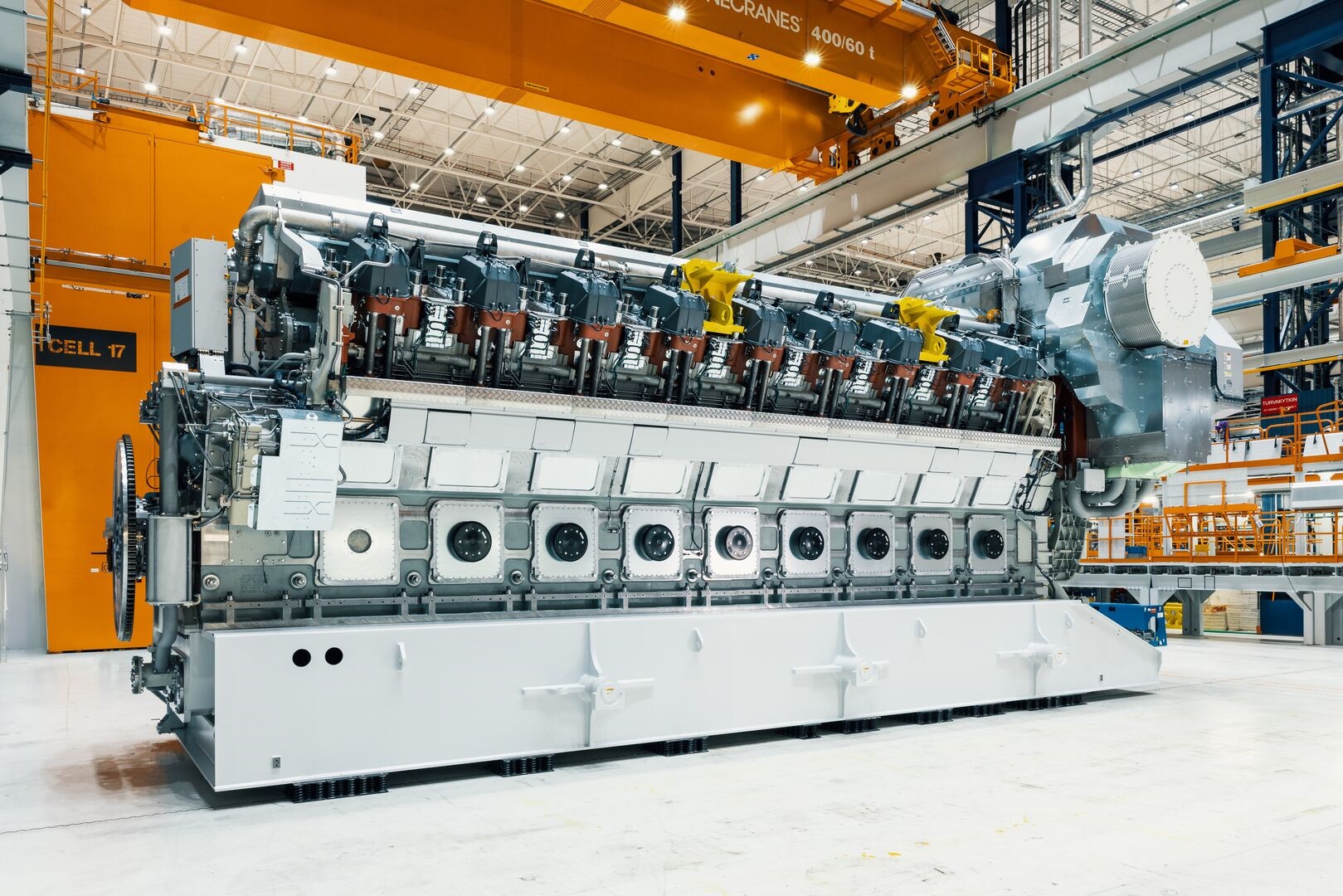

Capacity expansion to support long‑term growth

To meet rising demand, Wärtsilä recently announced a EUR 140 million investment to expand engine manufacturing capacity at the Sustainable Technology Hub in Vaasa and within the global supply chain. Combined with the previously announced EUR 50 million investment, the expansion will increase technical capacity by 35% and will be operational in early 2028. This reflects the company’s confidence in sustained structural growth in both balancing power and baseload applications such as data centres.

Q&A

What is Wärtsilä’s competitive advantage in data centres versus other engine manufacturers?

Compared with high-speed engines, Wärtsilä’s medium-speed engines have advantages in efficiency and engine size. When compared with other medium-speed engine suppliers, Wärtsilä’s strongest differentiator is its extensive global service network, particularly in the US. For data centre and balancing power customers, high availability, reliable starts, and rapid maintenance support are critical. Wärtsilä’s service capability and installed base provide confidence that plants will run reliably over their full lifecycle.

High-speed engine suppliers have an advantage in terms of existing customer relationships due to their long history in backup power for data centres, but as the market shifts toward large baseload applications, Wärtsilä expects to continue gaining share.

Gas turbine players have announced many gigawatts of data centre orders while you have announced less than one gigawatt, year-to-date. What kind of pushbacks are you getting?

Our customers are evaluating different technologies in different dimensions, and we have a strong proposition. But it is good to note, that our customers know the turbine suppliers very well from the past. We are less known, especially in the US. Engines are a new technology for them, so we need to get our message out there. We believe, that once they try our technology, they notice that it’s very competitive. A proof point of this is that we already have repeat customers in other power plant applications in the US.

Beyond engine manufacturing capacity, are there any other constraints in the US data centre projects that could delay delivery schedules? Could external bottlenecks make Wärtsilä’s faster lead times irrelevant if the project cannot progress anyway?

The current market is extremely dynamic, and customer feedback indicates strong demand visibility extending into 2029 and even 2030. From Wärtsilä’s perspective, the primary external risk factors are geopolitical, such as trade dynamics and potential tariff developments, rather than infrastructure constraints.

Based on discussions with customers, there are no signs that broader project bottlenecks would negate Wärtsilä’s lead time advantage.

Given that data‑centre engines run as baseload and often at high utilisation, will this change the aftermarket intensity or your service penetration compared to traditional utility applications?

Data centre plants do run significant operating hours, but they also include a built-in maintenance reserve, meaning additional engines are installed to secure high availability. Those reserve units are not running continuously. Furthermore, actual load profiles vary throughout the year, and many data centres operate below full capacity for extended periods. Overall, the application will generate substantial service hours, but within a framework that already accounts for availability requirements and installed redundancy.

How important is fuel flexibility, such as future hydrogen capability, when comparing engines with gas turbines?

Fuel flexibility is part of long-term planning but is not a primary decision factor for customers today. Attributes such as delivery time, modularity, scalability, and water consumption, rank higher in current project evaluations.

In the longer term, customers are increasingly focused on integrating renewables and enabling flexible balancing. These capabilities, rather than alternative fuels alone, currently carry more weight in technology selection.