What does the future hold for small merchant vessels?

Small merchant vessels are the workhorses of the marine industry. An ageing fleet and tightening regulations are impacting local and global operations, so finding the right strategies to navigate the changing situation is more urgent than ever. A recent Tech Talk on the subject hosted by Wärtsilä revealed some intriguing insights from a panel of vastly experienced industry experts.

Are you an owner or operator of small merchant vessels and looking for new strategies to ensure profitability while complying with increasingly stringent regulations? Then this summary of the tech talk has plenty of food for thought to chew on!

You can also watch the webinar recording:

Why do blurry targets cause problems?

“There are confusing messages, certainly in the UK, around the long-term future of oil and gas,” explains Iain Salter, Head of Newbuildings at James Fisher Tankships. ”It's expected to peak around 2030, but then the UK is approving new oil and gas projects, leading to confusing projections for progress towards decarbonisation over the lifetime of a vessel, which for us is around 20 years. Our shareholders will question blurry targets, because it’s not clear what the return on investment will be.”

Andreas Hagberg, Head of Sales & Marketing, FKAB Marine Design notes how different customers are facing different obstacles. “One of the main concerns has been financial – it’s expensive to make upgrades and fulfil all existing and upcoming rules and regulations. Family-owned companies have tended to take steps to future-proof and upgrade earlier than shareholder-owned companies. Now good market conditions are allowing shareholder-owned companies to catch up.”

What is driving decarbonisation?

Where are the main drivers for decarbonisation coming from? Customers, cost, or regulations? “We’re only seeing it at a low level from customers,” shares Salter. “However, shareholders and the financial institutions that support us are asking questions about our green agenda and our strategy for decarbonisation.” Hagberg agrees: “To finance your business you need to make green investments for banks to want to support you. There is also great uncertainty about which future fuel to choose for newbuild owners.”

“One of the main drivers we see for decarbonisation for ship owners is the tightening regulatory framework in the EU,” highlights Hagberg. Göran Österdahl, Direct Sales and Sales Support, Power Supply at Wärtsilä Marine Power agrees that the regulatory framework is pushing the industry to decarbonise. “Long-term, if the tough decisions are not made there is a risk that operational costs will increase as a consequence of the regulatory framework.” Jonatan Höglund, Deputy CEO of Furetank, believes the overarching driver of decarbonisation comes down to survival: “If we don’t act now, we risk ending up in a situation that we will not be able to get out from.”

Where to invest – newbuilds or retrofits?

James Fisher Tankships believe that newbuilding is the way forward: “Due to the age profile of our fleet, upgrades and retrofits are of minimal benefit and economically unviable,” Salter says. “With existing vessels we focus on operational and energy efficiency.”

“For newbuilds, the immaturity of the technology for small ships is an issue, as is not being certain of what the emission reduction or environmental benefits will be,” Salter continues. “We’re spending roughly 50% at sea and 50% in port operation so it’s difficult to get clarity on how technology would benefit us.”

Hagberg is also mainly seeing newbuilds with just a few retrofits: “As most shipowners are keeping vessels for around 20 years and then selling them there is a limited time to get payback for retrofit investments.”

“When the availability of future fuels is clearer we will see more upgrading of small merchant vessels to run on them, says Österdahl. “At the moment it might be more logical to invest in new vessels.”

Are yard slots matching demand?

“We see a very high order book, particularly in the small tanker segment where the shipyards are predominantly Chinese,” Salter states. “When the order books are full it means the interest of the yards to take on higher risk projects is lower,” points out Hagberg. “Decarbonisation or any future technology is a risk for the shipyard and, while there is a healthy order book, the willingness to take that risk may be lower.”

“This offers companies such as Wärtsilä the chance to take on some of the risk, working with ship designers,” concludes Österdahl. “The right equipment, solutions and design can help de-risk new technology for shipyards and investors. Cooperation and collaboration is the way forward.”

What does the future hold for small merchant vessels?

The IMO’s carbon intensity indicator (CII) is already here and impacting businesses in different ways. “All but four of our vessels are below 5,000 GT and CII only applies to vessels over this figure,” Salter says. “Three of the four vessels we have that are over 5,000 GT are in the A–C rating, so it’s not been too much of an issue.”

“Preparing for the future, we’re looking at data gathering as well as digitalisation and data capture on newbuilds rather than data entry on existing vessels,” continues Salter. “This will give us an accurate feel for how efficient a vessel is and what we can do to improve it.”

“We spend a lot of time and effort during and between projects figuring out how we can make vessels more efficient to lower fuel consumption,” explains Hagberg. “Data collection, route planning and weather planning all bring down energy consumption. Today we see 12.5 knots as a typical design speed. If slower speeds are viable then there are a lot of gains that can be made with that approach.”

Is CII an imperfect measure? What are the issues in this regulation?

“The methodologies for penalties are somewhat questionable,” says Salter. “For example, we have a ship that was engaged in floating storage. The CII uses tonne-miles as a measure and the miles of this ship were next to zero, so it ended up with a very poor CII rating. Likewise, for EEXI we were required to derate some of the main engines on our larger vessels, but this had zero impact on the actual emissions produced because EEXI required an engine load of 75% which is above the power we required to maintain the charter speed. So these modifications had no real benefits.”

Höglund shares some of the same reservations. “Unfortunately CII is affecting different vessel types and segments quite unfavourably. For example, those that spend time in port or ferries that are being used as temporary hotel facilities.”

“We can also see the flaws,” agrees Hagberg. “All regulation needs to be adjusted along the way, and CII will be up for review in 2025.”

What will be the impact of upcoming EU regulations?

The EU Emissions Trading System (ETS) becomes applicable to Marine from next year, and Fuel EU Maritime, which concerns the carbon intensity of the fuel being burned, will be in place from 2025.

“The shipowners we work for have increasingly tough demands, and we help them to fulfil them,” shares Hagberg. “Everyone wants to build in flexibility for the future, so vessels need to have possibilities for later conversions and upgrades.”

“Because of the size limit and because we trade mostly into and out of UK ports, EU ETS doesn’t affect most of our vessels,” says Salter. “We have three vessels affected and we’re developing emission reduction plans for them as a priority. We are also looking at longer range commitments like 2050, so even with vessels we’re procuring now emissions reduction is still very much a focus for us.”

“EU ETS will also make fuel bills more expensive,” adds Österdahl. “Energy use and fuel slip is being discussed more often thanks to the EU rulebook, which is much clearer in my opinion than IMO regulations. The costs for compliance with EU ETS will usually end up being paid by end users and consumers.”

How can fuel flexibility help to prepare for the future?

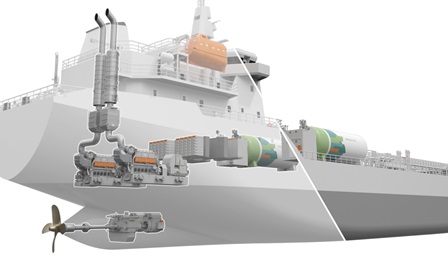

A large part of preparing for future regulation is ensuring flexibility. “For owners, it often comes down to fuel,” shares Hagberg. “Every project we’re working on we’re discussing what fuel they will be going for. We see LNG, methanol and ammonia being discussed, but mainly LNG and methanol. LNG is one step ahead at the moment and I don’t think it has yet reached its peak. I think it will be a mix of fuels that is the solution, in combination with things like batteries and energy-saving technologies.”

“We did quite a lot of analysis on whether methanol would achieve real-world carbon savings from day one and concluded that with the engine technology in our sort of power range it would not. LNG dual-fuel has matured somewhat in our power range – we built our first LNG dual-fuel vessels in 2022. LNG allows us to make real-world savings from day one, but we’re still seeing it as an interim solution considering the 20-year lifespan of a vessel.”

“Wärtsilä has been focussing on LNG for more than 20 years,” shares Österdahl. “Methanol has certainly caught people’s attention in the last year or so, but personally I think ammonia is an interesting fuel, considering it offers potentially zero emission in relation to CO2.”

What are the barriers to future fuel adoption?

“The infrastructure is one thing being discussed,” shares Hagberg. “LNG is there and available for all, but the other fuels aren’t as developed. And all the time we come back to well-to-wake – how green the fuel is in reality.”

“Firstly, engine makers typically take a top-down approach to developing their engines,” Salter states. “They start with the two-strokes and then move onto the four-strokes, which is understandable. It doesn’t help us much though as we’re typically a consumer of much smaller engines. Secondly, the energy density of alternative fuels is a significant issue for us because our vessels are physically constrained by the ports we visit. It’s a simple trade-off between range and how much cargo we can carry. When you start looking at methanol, and particularly hydrogen where the energy density is incredibly low, it’s a huge problem. Finally, the availability of future fuels – particularly in the UK, even the infrastructure for LNG is very poor and the methanol supply is pretty much non-existent.”

What’s next for the small merchant segment?

The future focus needs to be on efficiency,” Salter highlights. “There’s no point in throwing all your investment into alternative fuels if you’re fundamentally not putting the energy where it needs to go in the most efficient way. Voyage optimisation and vessel autonomy are the way forward to achieve energy efficiency. If you have vessel autonomy you can make more intelligent decisions, allowing you to plan your voyage to save fuel and emissions.”

“Efficiency will be essential, and one fuel will not solve everything. Collaboration will be key. We need to do this together – by sharing knowledge we will progress faster.”

“We will see a fuel mixture in the future,” concludes Österdahl. “In the short-term we will see biofuel being used, methanol will capture some of the fuel share, ships will be more flexible and they will be prepared to use and even store electricity from shore. As for ammonia, we just need to wait and see.”

With vessels aging and regulations tightening, there is no time to waste if the small merchant fleet is to navigate the choppy waters ahead and remain profitable and compliant. Contact Wärtsilä to discuss how we can help future-proof your small merchant vessels.