Pipeline natural gas and liquefied natural gas (LNG) have been readily available in some geographical markets. Thanks to diversification, LNG now has the potential to become easily available, worldwide. Read on.

Pipeline natural gas and liquefied natural gas (LNG) have been readily available in some geographical markets. Thanks to diversification, LNG now has the potential to become easily available, worldwide. Read on.

With a new fuel comes the question: How much is it reasonable to pay for it? Crude oil is traded globally on a scale that leads to a completely liquid market with transparent pricing. It is not difficult to contract heavy fuel oil (HFO) or light fuel oil (LFO) as there are benchmarks and multiple suppliers available. It is also feasible to transport these fuels fairly long distances. The picture is very different for small-scale LNG. In many parts of the world, there is only one supplier or, in the best-case scenario, a few. Furthermore, the prices published for conventional, large-scale LNG deliveries have very little use for someone interested in contracting smaller quantities.

When the buyer has no or little experience, the seller has the power in negotiations. Therefore, this article aims to provide a few pointers to level the playing field. In order to understand the small-scale LNG contracts, one has to have some knowledge about how large-scale LNG is contracted.

Unlike the crude oil market, the gas market cannot be considered a uniform international market, as regions are not interconnected and trading is still fairly uncommon. Therefore, pricing mechanisms have developed differently in different parts of the world. So while LNG prices have largely been linked to crude oil or a basket of oil products in Asia, they were initially linked to Brent oil in Europe, but are now increasingly moving towards hub prices following the increased liquidity of the NBP (United Kingdom) and TTF (Netherlands) gas hubs.

In North America, gas markets are hub based, with Henry Hub being the most well-known. When prices diverge between regions, arbitrage opportunities are created. This means excess large-scale LNG will go to the region that is willing to pay the highest price. There is currently, and for several years to come, an oversupply of LNG, which has improved the bargaining position of buyers. This is leading to more variation in price indexation, more spot trading, shorter-term contracts (previously 25-year contracts were common) and destination flexibility: Free On Board (FOB) instead of Delivered Ex-Ship (DES).

Large buyers hedge their LNG prices by having a portfolio of contracts with different suppliers and pricing mechanisms. This is a luxury small-scale buyers do not have. If a small-scale buyer has only one supply contract, there is less room for error. Therefore, there are some clauses in an LNG sales agreement which small-scale buyers should pay extra attention to.

Start date

Since there are not many alternative buyers and sellers for small-scale LNG, the delivery of LNG in accordance with the timetable of the contract is crucial for both parties. But during this time, if either the buyer or the seller of LNG is constructing a new facility, this could present a major risk. As LNG sales agreements should be negotiated and signed before the construction of the facility, assigning a realistic start date is of utmost importance. There should be a funnel where the start date of the contract is specified in an increasingly tighter time range as the facility comes closer to commissioning. Schedule slip could have serious financial consequences.

Logistics

In large-scale LNG, the trend is towards increased destination flexibility. The buyers want FOB contracts instead of DES, so that they can divert cargoes to spot buyers in case they do not need them. This is not really applicable in the small-scale market, since LNG cannot be economically transported very far on small-scale carriers and there are few alternative customers. However, having the shipping component in one’s own hands might save some money for the buyer, but FOB contracts would also require the buyer to assume responsibility for ship charters, insurance, boil-off gas and port costs. In some cases, DES contracts are advantageous if the supplier can utilise the same ship for other customers and share the costs. Those new to the market would be better off with a DES contract. But to shave off some hidden cost, considering FOB may be a good option.

Table 1 - Differences between large-scale and small-scale LNG.

Contract length

The contract length is often determined by the financing needs of the parties as financial institutions require certain guarantees. For a utility looking to build an LNG terminal for its power plant, this means a fuel supply contract that is back-to-back with the length of the power purchase agreement. But even without such requirements, a medium-term contract might be preferred. The trend in large-scale LNG is towards shorter contracts and spot deliveries, but in small-scale LNG one wants to make sure that supply of fuel is guaranteed for a longer time. However, if one expects that the number of suppliers in the region will increase, it might be a good idea to have a shorter contract, so that a new contract can be negotiated when the buyer’s bargaining position is better.

Annual Contract Quantities

One challenge with a long contract is that the quantities required may change considerably. Given the fact that a liquefaction facility wants to produce at a steady rate and there seldom are other takers for a cargo, the seller wants to make sure that the buyer takes the cargoes that have been assigned to him. Also, the buyer wants to be certain that his fuel needs can be met. Therefore, the contract specifies an Annual Contract Quantity (ACQ). These clauses generally allow for some downward flexibility. The buyer has to pay for the cargoes whether he takes them or not (Take-or-Pay), but the outstanding cargoes should be taken the following year, in addition to the normal ACQ. Strict ACQs and Take-or-Pay work fairly well for national gas grids and baseload electricity production, but for power plants running peak loads, the buyer would like considerable flexibility when it comes to annual quantities. If the LNG supplier is the only source of fuel (meaning there are no alternative suppliers and alternative fuels cannot be used), it is also important to specify what happens in case of failure to deliver.

Timing

The timing of negotiating an LNG sales agreement also matters as these contracts contain a price review mechanism with the purpose of restoring the conditions of when the agreement was signed. The base period of an index is defined in the contract and constitutes the reference period for the price. The base period values will affect future prices, so it is important not to accept one that would result in a future disadvantage.

A review period for determining the index to be applied is also specified. Instead of choosing a particular day as reference point for the index, an average over a longer time period is chosen. The intention of this is to smoothen out peaks. The period is usually with a lag if time is needed in order to collect the data for calculating the index.

If the contract is increasingly disadvantageous to one of the parties of the contract, it should be returned to equilibrium. The contract should state a price adjustment frequency. With a suitable frequency, the price is kept close to the market level. Buyers would ideally want to mirror the same price adjustment frequency they have with their own customers.

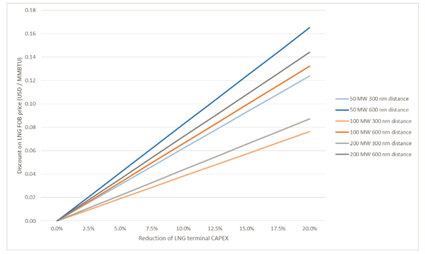

Fig. 1 - Discount on LNG FOB price compared with a reduction of LNG terminal CAPEX.

Pricing mechanism

The price of LNG is obviously one of the most important points when negotiating an LNG sales contract. With few suppliers to choose from and a low level of experience among buyers, it is often the suppliers that have the upper hand in deciding the terms. The principles of a fair agreement should be that the price provides an acceptable return on investment for its facilities and operates at a reasonable profit. The seller wants the price to reflect the market value of the gas, while the buyer wants an advantage over competing fuels. Buyers also want the price to mirror the price risk in the sales of their products or services (e.g., electricity). In case of a new market with poor credit ratings, the seller would also require a premium in order to cover the credit risk.

Prices are linked to different indices in different parts of the world, and generally small-scale LNG is influenced by large-scale LNG. Most often in South-East Asia, prices are linked to Brent crude oil, in Northern Europe to TTF hub prices and in the western hemisphere to Henry Hub. This is understandable as LNG suppliers don’t want to absorb the price risk of buying according to one index and sell according to another. But this is not necessarily in the interest of the buyer. Ideally, a consumer wants to make sure his fuel costs are lower than the competitor’s. If the competitor is using HFO or LFO, this is the preferred index. For the buyer, it would be ideal if the price would be linked to a local index, but as they seldom have sufficient liquidity, the seller probably insists on an international index. It is common to use Brent crude as an index, which is beneficial since it is easy to hedge, but there is no guarantee that the price of crude oil and refined products cannot diverge in the future.

Other, more experimental indexing can be considered if the buyer, e.g., a dual-fuel power plant, can use other fuels. Then a different index can be chosen, e.g., Henry Hub or NBP, so that one can play with price differences and produce using the fuel that is currently most affordable. Such a strategy might, however, be difficult to align with the Annual Contract Quantities.

What can be seen in reality is that suppliers of small-scale LNG offer a hub or oil products index plus a fixed component. The fixed component comprises not only the logistical costs in a DES contract, but also reduces the transparency of the pricing mechanism. By coincidence or not, the final price often ends up close to the cost of the competing fuel.

A few cents per MMBTU might sound trivial, but it has a substantial impact on the cost price of gas for the LNG terminal. Figure 1 illustrates the significance of a discount on the FOB LNG price compared with a reduction in total infrastructure cost for a generic LNG terminal (including marine infrastructure) designed to supply gas to a 50, 100 or 200 MW power plant located at a distance of 300 and 600 nautical miles, respectively, from the LNG supplier.

From the figure, it is apparent that even a minor discount on the LNG price has the same impact as reducing CAPEX spent on the LNG terminal by several million USD. While spending less on the LNG terminal will result in lower performance, reliability and perhaps safety, the properties of LNG will not change when lowering the price. The savings also remain more or less the same in both low and high price environments. Therefore, the LNG sales contract should be given considerable deliberation and if needed, an experienced consultant should be brought in to support negotiations.

Did you like this? Subscribe to Insights updates!

Once every six weeks, you will get the top picks – the latest and the greatest pieces – from this Insights channel by email.