How to boost power-generation profitability with operational flexibility

Unlock new revenue streams with power generation

Flexible power generation is no longer optional – it’s essential for balancing intermittent renewables and maintaining grid stability. But that’s not all. For asset owners such as utilities and independent power producers (IPPs), flexible power generation can also unlock new revenue streams and reduce financial risks – but only if you choose the right technology.

From grid support to profit

Energy systems around the world are shifting towards more liberalised models with real-time dispatch and shorter settlement intervals. Price volatility in these electricity markets is increasing because of the intermittent nature of renewables. Owners of flexible power generation assets are uniquely positioned to capitalise on these market fluctuations.

These asset owners already have a competitive edge in multiple markets across the globe, from the USA to Australia. They can use the operational flexibility of their assets to respond rapidly to price fluctuations and participate in ancillary services and capacity markets.

Deploying flexible power generation assets, especially in liberalised markets, allows owners to extract maximum value from their assets by unlocking new revenue streams and reducing operational risks.

How to monetise your flexibility: Five proven revenue streams

With flexible power generation assets, utilities and IPPs can take advantage of increased volatility by tapping into multiple revenue streams, such as:

Bilateral contracts

Power plant owners can generate revenue through bilateral contracts like PPAs, which offer fixed pricing over set periods. With flexible power generation assets, owners can package together a renewable energy portfolio and firming assets in a value-adding PPA. Alternatively, they can offer time-of-day contracts for specific demand periods.

Energy markets

Owners can sell electricity in day-ahead, intraday and real-time markets, adjusting output based on the latest prices and forecasts. This enables them to capitalise on price volatility, stack revenues with other services, and optimise returns by responding quickly to market signals. Flexible assets can stay offline when prices are low and ramp up during price spikes.

Capacity mechanisms

Capacity mechanisms provide steady, low-risk revenue by paying asset owners for available capacity rather than energy delivered. These payments can be stacked with other revenue streams because they reward readiness rather than dispatch. Capacity payments are determined with different methodologies across different markets, such as through capacity accreditations and auctions. In the USA, capacity accreditation is used to determine how much dispatchable capacity a technology can contribute to meet peak electricity demand. For utilities and IPPs, a high accreditation value translates into greater eligibility for capacity payments. It also strengthens their business cases in resource adequacy markets, making their power generation assets attractive in terms of both grid reliability and long-term revenue stability.

Ancillary services

Ancillary services help to maintain frequency, voltage and grid reliability in real time. In countries where ancillary services are auctioned in short intervals, for example 5 minutes, owners of fast, flexible power generation assets can dynamically adjust their capacity allocation to maximise profitability.

Financial markets

Electricity derivatives markets, which operate globally, allow owners of flexible power generation assets to hedge against price fluctuations and secure additional revenue. This revenue is generated by trading financial instruments that are settled based on realised electricity prices.

Stack your revenues, maximise your returns

Owners of flexible power generation assets can shift between multiple revenue-generating services throughout the day and across market cycles. This dynamic capability is known as revenue stacking, and it's the key to maximising power-generation profitability in volatile energy markets.

By monitoring real-time market signals, regulatory changes and asset performance, operators can dynamically allocate capacity to the most profitable service at any given moment. This agility transforms flexible assets from backup solutions into core profit engines.

With revenue stacking, timing is everything. For stacking to succeed, it is critical to understand when markets are procured and how different services interact with each other. For example, capacity auctions are locked in years ahead of time, while energy and balancing services are traded in near real time. Understanding local mechanisms is key to maximising your returns.

How to unlock new revenue streams with flexible engine power plants

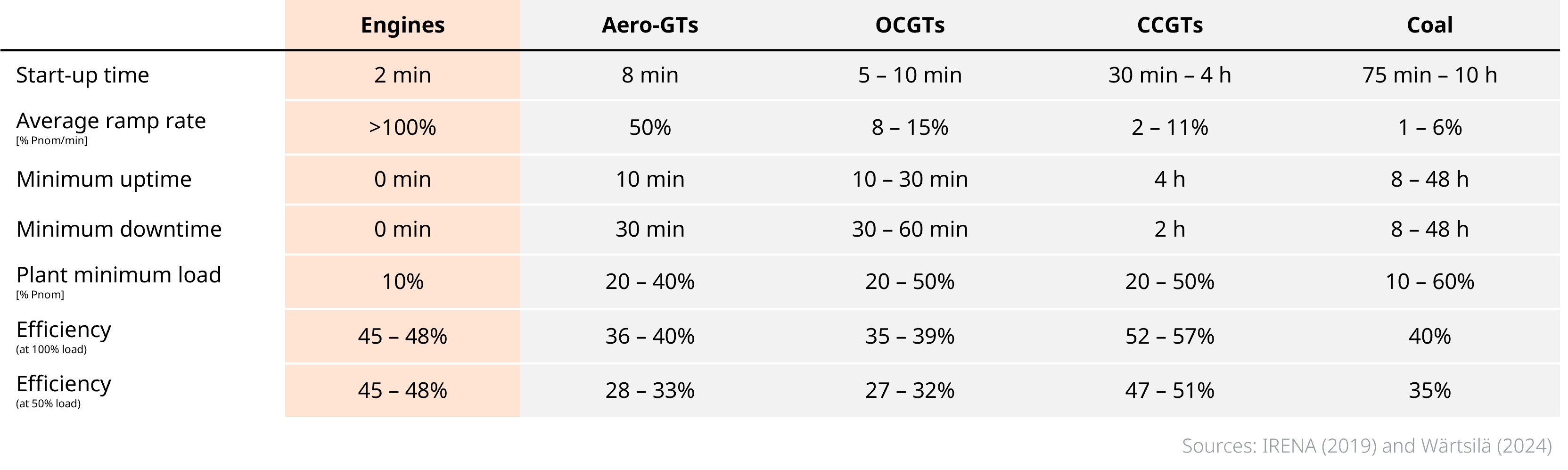

Engine power plants are one of the most flexible power generation technology available today because they can start, stop and ramp up output faster than any other technology. This makes them ideal for capturing value in advanced electricity markets, where speed and flexibility are essential.

We have compared our engines to aero gas turbines and can prove how engines can cycle continuously and operate more efficiently, even at partial loads and under extreme conditions, than aeros.

Learn more about this comparison: Power generation that ramps up in a heartbeat.

Monetising engine power plants: case studies from around the world

Read about cases from around the world where energy companies are monetising their flexible power generation capability:

USA

Engine power plants capture 1.6× more real‑time market revenue in Texas, USA

Download

Australia

Creating financial value with operational flexibility in South Australia

Download

Japan

Flexible engine power plants in Japan provide reliable profits and support the grid

Download

The Philippines

The Philippines

Advantages of engines as balancers in the Philippine 5-minute WESM and reserve market