In accordance with the IRP2010 and Ministerial Determinations, South Africa (SA) will soon embark on a large, new-build gas independent power producer (IPP) programme for 3126 MW, most of which will likely be supplied initially with imported liquefied natural gas (LNG). However, SA has not yet defined the plant performance criteria that will ensure the maximum system benefit. Modelling can determine the true operational requirements for SA’s future gas to power opportunities. This article is based on the award-winning paper (Highly Commended): “Optimising the South African power system with ultra-flexible LNG power plants” presented at the Power-Gen Africa 2016 conference.

The regulatory context for new gas capacity

For many years, SA has obtained most of its energy needs from large-scale, coal-fired power stations, but this capacity mix is changing rapidly, due to increasing environmental pressures and the need for a diversified energy mix, as discussed within the Integrated Energy Plan (IEP) and the Integrated Resource Plan (IRP).

In 2012, the Minister of Energy released determinations for the construction of 3126 MW to be procured through the establishment of IPPs and, in May 2015, sought a wide range of gas-related energy projects with a focus on LNG-supplied projects (The Republic of South Africa - Department of Energy, 2015). Key features included the following:

3 GW of capacity would have a 35% load factor for the years 2020, 2025, 2030.

Power plants would require “intra-day flexibility with lower-load factors during night and higher-load factors during the day and evening peak hours.”

In this context, we examined the gas flexibility requirements for the SA power system and linked them to the complexities of the LNG supply. First, we highlight some of the variables that influence what the system will require from future gas capacity.

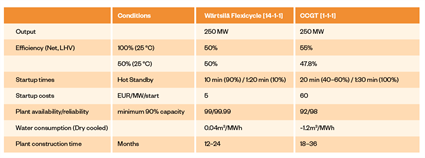

Table 1 - Key parameter comparisons between a Wärtsilä Flexicycle power plant and a CCGT power plant.

Future system variables

A few events contribute to both the long- and short-term uncertainty and variability of the power system and have a significant impact on the role of gas in the power system. These events include the following:

Increasing renewable energy

Increasing coal plant unavailability/decommissioning

Varying country demand

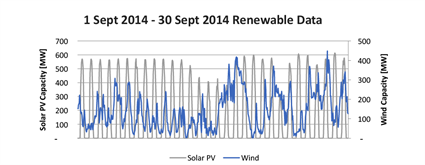

Through the successful Renewable Energy Independent Power Producer Programme (REIPPP), SA has a total of 6.3 GW already procured, with a total allocation of 13,225 MW to be built predominantly through wind and solar energy (Creamer Media, 2015). The drawbacks, however, arise from the intermittent nature of these sources. (Figure 1)

Because of this intermittency, increasing the relative share of renewables in the power system creates system imbalances for which flexible measures must be introduced. If South Africa follows the planned capacity increases per the IRP, it can anticipate an 11% penetration by 2020 and 26% by 2030. According to the International Energy Agency, a power system starts to experience the effects of variability from renewable sources after only reaching 5% penetration levels (International Energy Agency, 2014). Thus, there is a clear need to start planning today for this increasing intermittency or risk decreasing the reliability of the grid.

In parallel to the increase in renewables, the system will lose coal baseload capacity, due to lower availabilities and decommissioning taking place from 2019 (Republic of South Africa, 2011). Eskom’s coal stations have been rapidly decreasing their availabilities, from 90% in the early 1990s down to 75% in 2015 (NERSA, 2015) (Moneyweb, 2015). In addition, most of the existing coal fleet is planned for decommissioning between 2025 – 2030 (Republic of South Africa, 2011).

Perhaps the biggest factors in the future health of the power system are the country’s growth and demand for electricity. The years 2012 to 2017 illustrate the level of unpredictability – from the country’s demand with rolling blackouts ensuing in 2015 to a surplus of capacity in 2017. And whilst South Africa is not currently under an energy constraint, history has shown that the country’s demand is erratic and unpredictable, which will likely remain true going forward.

Clearly, the power system is subject to a multitude of variables that continuously alter the balance of energy supply and demand. It is exactly in this ongoing balancing act that gas power can play a pivotal role in ensuring the long-term reliability of the South African power system.

Fig. 1 - Renewables are highly intermittent in South Africa, as can be seen from aggregated energy production of solar and wind over one month from the REIPPP.

Gas technology review

Two available options for prime movers to convert gas into electricity are internal combustion engines (ICE) and gas turbines (GT). Due to the higher efficiencies that combined cycle configurations offer, we limit our analysis to the following configurations: Wärtsilä Flexicycle technology (combined cycle technology in reciprocating engines) and CCGTs (combined cycle gas turbines). We will, however, learn from this analysis that efficiency is not a priority factor and that flexibility is an important consideration when looking to create an optimal power system.

The Wärtsilä Flexicycle solution is based on a gas, multi-fuel, or liquid-fuel power plant combined with a heat recovery steam generator (HRSG) and steam turbine. Wärtsilä Flexicycle power plants can operate both in highly efficient, combined cycle mode and in dynamic, fast simple cycle mode.

The combination of flexibility and efficiency makes Wärtsilä Flexicycle power plants ideally suited to load-following in a power system whilst also being competitive at near baseload dispatch profiles. Wärtsilä’s Flexicycle plants are composed of standardised modular units, allowing for fast construction times and easy expansions. Dry-cooling technologies, which use approximately 96% less water than a conventional CCGT plant, may also be considered. The table above compares the key features of the two plant types included in the power-system modelling analysis.

SA’s energy and reserve requirements

To understand the role of gas in South Africa, the discussion is divided into two main areas where gas power traditionally plays a role, namely, electrical energy and operating reserves:

Electrical energy requirements are the forecasted energy requirements of the grid, based on a predicted demand/supply balance. Generators used to supply energy to the system will have a pre-defined dispatch profile that varies depending on the cost of providing energy versus the demand for that energy. The most familiar, simplified profiles are that of baseload, mid-merit and peaking.

Operating reserve requirements refer to the capacity made available to the power system within a short interval of time in the event of an imbalance between supply and demand.

Compared to the electrical energy requirements of a system, the role of the reserves is somewhat less obvious but equally important in maintaining the reliability and quality of the supply. This fact becomes even more apparent as the level of renewable energy increases in the system.

Globally, gas generation capacity often is used to meet one or both these requirements. We now discuss if and how gas satisfies these roles in the South African power system context.

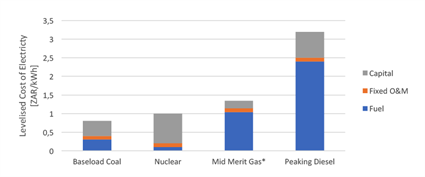

Fig. 2 - As long as LNG is used as a feedstock, it is unlikely that gas tariffs will be lower than coal or nuclear tariffs.

Energy requirements

To understand the energy requirements of gas, it is important to distinguish where it ‘fits in’ with the available alternatives, based on the cost of producing energy. For this, we take guidance from work done by the Council for Scientific and Industrial Research (CSIR), which has performed calculations to compare the new-build tariffs for various technologies, as depicted in Figure 2.

As shown, gas capacity (from engines or turbines) sits between coal and diesel capacity, due to the high fuel component that has been assumed to be R150/GJ. Even considering gas prices of R100/GJ or R200/GJ, it still will not change the relative merit order for gas.

But as gas is situated after the large amount of coal on the system’s dispatch merit order, it is far more susceptible to any system supply/demand variations, resulting in a continuously variable annual energy load factor.

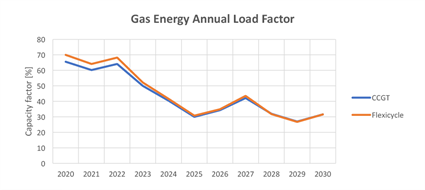

Figure 3 shows this varying load factor for either 3 GW of CCGTs or 3 GW of Wärtsilä Flexicycle capacity, in an IRP2010 ‘base case’ scenario with a ‘moderate growth’ path and 73% coal availability from the ageing coal fleet.

Note that, every year, the energy load factor requirements change, due to changes in baseload capacity with new capacity coming online (i.e. nuclear in 2022) or old capacity going offline (i.e. old coal stations in 2027). As a result, gas projects should not be designed according to a fixed average load factor but should be capable of effectively providing a wide range of load factors that could be anticipated for gas. Indications from the latest IRP reveal that gas is typically used in load factors of 20–40%.

Fig. 3 - Engines and turbines play a similar role in providing the constantly varying energy requirements of the power system. Note: Assumptions: 3126 MW available from 2020; ‘moderate growth’ path for demand used; old coal plant availability is 73%.

Operating reserve requirements

To date, Eskom largely relies on its newest coal fleet to meet the system’s reserve requirements, with diesel turbines used as a backup. These are the only plants of sufficient capacity that are technically capable of meeting the short-term demand and supply variations. However, continuously providing varying energy escalates the degradation experienced by these coal units, thus leading to increased operational costs and reduced reliability levels. But, with the introduction of gas as an option, there are now opportunities for flexible gas power plants to undertake some of these reserve requirements.

The system has three types of operating reserves: regulation, instantaneous and 10-minute reserves. Each reserve type serves a different function and is largely characterised by the required response time. Of particular interest to us is the 10-minute reserve category, as it is likely that gas will be utilised best in fulfilling these requirements, due to the relatively high cost of energy from LNG-sourced gas. This reserve type is used to restore the regulating and instantaneous reserves and must be fully activated within 10 minutes from either a spinning or non-spinning state. This allowance to provide these reserves from a non-spinning state is an important one and is elaborated further in the section below.

Per Eskom (Eskom, 2015), the system will require 1100 MW of 10-minute reserves by 2019. This value will likely increase significantly as the contribution of intermittent renewable energy increases. However, for this study, we have assumed a conservative annual increase of 50 MW.

Spinning vs. non-spinning

A plant operates in spinning mode when the prime mover (either an engine or turbine) is physically rotating and in non-spinning mode when not rotating. This simple distinction has significant economic relevance as plants operating in spinning mode require ongoing variable maintenance and have reduced part load efficiencies, resulting in a higher net tariff. Thus, to reduce expenditures incurred by the spinning plant, it is preferable to use technologies that provide non-spinning reserves.

The key distinction between engines and turbines is that engines can fully satisfy the regulating reserve requirements from both a spinning and non-spinning state, whereas turbines can only do so partially from a spinning state. Based on this, the power system can achieve overall efficiency improvements by replacing existing spinning reserves, operating at suboptimal output efficiencies, with fast-starting, non-spinning reserves that operate at maximum efficiency. Operating costs can be lowered further by replacing ill-suited capacity (such as coal), with high technical degradation from cycling, with engines that incur negligible start-up and cycling costs.

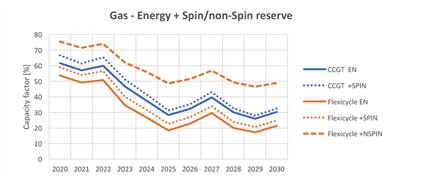

Fig. 4 - The ability of engines to provide reserves from a non-spinning state increases their total effective load factor by 20-30%.

System effects from gas energy

To show how the two primary, gas-based, power generation options satisfy the respective reserve and energy requirements, we introduce 3126 MWs of either turbine or engine technology into the system and allow the software to determine how this capacity is best used. The parameters observed include the following:

Energy load factor (EN)

Spinning reserves load factor (SPIN)

Non-spinning reserves load factor (NSPIN)

Figure 4 indicates the cumulative turbine and engine load factors for energy (EN) and reserve (+SPIN and +NSPIN) provisions over a 10-year period.

In the earlier years, only 5% of the installed CCGT turbine capacity is allocated to providing reserves from a spinning state, and energy requirements in 2020 are 62%. Whilst we see a lower demand for energy supply (55%), there is significantly more demand from the system for the engines to provide reserves from both a spinning and non-spinning state. This high-reserve utilisation effectively pushes the total engine plant load factor to over 75% in 2020, which is 15–20% higher than the total turbine load factor throughout the 10-year period.

Interestingly, the ‘engines only’ scenario selects only engines to provide the entire amount of reserves required by the system, whereas coal capacity is still the preferred reserves provider in the turbine case. These findings are perfectly aligned with the technical differences between the technologies and highlight the benefits of having ultra-fast starting capabilities.

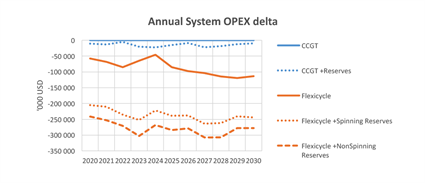

As the model dispatches plants with the lowest total system cost, we can extract the total system savings attributable to having both Flexicycle and CCGTs providing reserves to the system. Figure 5 shows the annual savings achieved by both Flexicycle and CCGT plants providing spinning and non-spinning reserves and CCGTs providing the baseline (with cumulative savings derived from the spinning and non-spinning reserves).

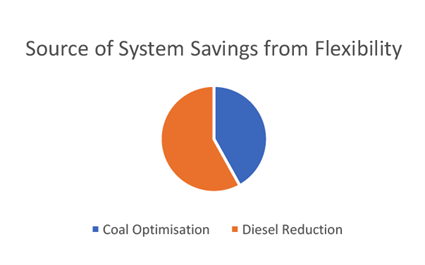

Not only do the engines provide system savings as an energy provider, but when allowed to provide non-spinning reserves, the savings can exceed US 250 million per year. But how? To illustrate, we compare the total generation cost of each technology and identify the cost variations for each of the scenarios. What we see is that the cost variations mainly occur in two areas, diesel replacement and coal optimisation. (Figure 6)

Due to the extremely high cost of diesel, diesel replacement is an obvious use of gas. But when we consider how savings are created from the coal optimisation, we discover two sources of savings in the following areas:

Reducing the costs incurred by starting and stopping the coal units

Reducing the part-load operational requirements, thereby allowing the coal fleet to operate at maximum output efficiency, without incurring additional ramping costs

These findings once again prove that gas is best used as a flexible energy source, as this is how the system realises the most benefit.

Fig. 5 - ICE technology creates savings as both an energy and reserves provider to the power system.

Fig. 6 - The system savings generated by flexible capacity from optimising the coal fleet and reducing diesel consumption.

Considerations for LNG supply

The next step to consider is how this flexibility can extend into the LNG Gas Supply Agreement (GSA). The convergence of these two distinct industries presents certain challenges, as the LNG value chain traditionally favours stable energy supplies whilst the power value chain clearly favours (as proven above) flexible energy supplies.

In this section, we give an overview of key market-, technical-, and contractual-related aspects that have an influence on the ability to provide LNG flexibly.

Trends in LNG supplies

LNG trade is rapidly evolving as new gas discoveries and new consumers enter the market. Trends and predictions reveal higher growth in LNG production than in consumption, thereby supporting a ‘buyers’ market’ that allows new consumers to negotiate better terms.

In the GSA negotiations, purchasers are pushing suppliers for greater volume flexibility to better suit their energy demand requirements, but even so, buyers are not exempt from requesting or discarding LNG cargoes at very short notice. Buyers still must present their requests in advance to allow for LNGCs to be identified and travel to the port of delivery. This is a feat not easily achieved when needing to predict the energy requirements, which literally change like the wind.

Naturally, as flexibility increases, the price of LNG also increases, as LNG suppliers will have greater financial risk exposure. But this price increase needs to be evaluated against the benefits of having flexibility downstream, which in our case is the system savings from having flexibility on the grid. Next we review exactly how these gas contract limitations and costs were considered in the integrated power system modelling.

Modelling the LNG supply

Here we present two approaches that favour either a cost-optimised LNG GSA (Option A) or the power system requirements (Option B).

OPTION A: optimal cost LNG GSA approach

In considering the entire LNG value chain, gas must pass through several distinct stages before reaching the power plant in a usable form:

Production – Liquefaction – Maritime transport – Storage/regasification – Pipeline – Power station

Whilst our intention here is not to discuss the complexities of each, we can highlight some broad principles that help achieve the lowest cost for gas delivered to the power plant.

The principles of high fixed volumes of supply hold when attempting to minimise LNG costs. By using infrastructure investments sized to take advantage of the economies of scale at each stage, one can reduce the per unit cost for each molecule delivered. Pressure to maximise and stabilise the volumes is seen at the liquefaction plants, which represent massive investments requiring long-term certainty of throughput to finance them. Pressure is also found at the storage and regasification facilities, which in South Africa’s case, may potentially be an FSRU solution (Reuters, 2015). Depending on various ocean conditions and jetty and FSRU designs, maximum LNG throughputs typically range from 3–4 Mtpa, which is enough to supply 3 GW of Flexicycle capacity at a load factor of 75%.

In addition, requiring a 100% take-or-pay obligation from the buyer over a long-term contract (i.e. 20 years) give the supplier financial security, in exchange for which the buyer can get the lowest molecule price, estimated in this study to be 10 USD/GJ.

OPTION B: optimal power system approach

As in Figure 4, the 3 GW of gas capacity may experience annual load factors between 80% (with reserves) and 20% (without reserves). This equates to potential LNG volume supply variations of approximately 1-3.5 Mtpa! Requesting this degree of flexibility will result in LNG suppliers imposing a premium for cargoes that potentially would be cancelled by the power plant dispatcher. The exact increase would be largely determined by the project specifics, but for our analysis, we have adopted an ultra-conservative premium value of 5 USD/MMBtu making for a total gas price of 15 USD/MMBtu.

Based on the above options, we have proposed the following two GSA model structures:

– OPTION A – Inflexible: 3 Mtpa of 100% take-or-pay at 10USD/MMBtu

– OPTION B – Flexible: Unrestricted volume with no take-or-pay obligations at 15USD/MMBtu

Integrating the LNG and power perspectives

We now assess the impact of integrating an inflexible (Option A) and flexible (Option B) LNG supply, by varying the delivered LNG price and imposing specific contractual obligations on the LNG supply. We then review the system impact to see whether this ‘cost of LNG supply flexibility’ has an impact on how the gas plants are operated.

Gas power load factors

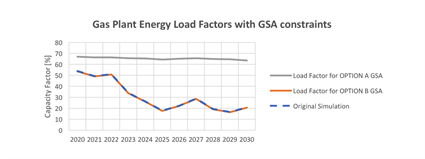

After imposing LNG GSA constraints, how the gas plant is dispatched may differ from the calculations in Figure 4. Figure 7 compares plant load factors with GSA Options A and B and the initial calculation (which assumes flexible LNG priced at 12USD/GJ).

With Option A, there is a fairly constant load factor of 64–67%. However, as this is lower than the 3 Mtpa capacity to supply a 75% load factor, 15% of the LNG delivered would be paid for (due to take-or-pay obligations) but not consumed. So if the gas power is not required by the system, it is optimal not to dispatch the power plant and incur the take-or-pay penalty.

If we now compare Option B to our original simulation, the only difference is the gas prices (12 vs. 15 USD/GJ). This finding reflects the fact that the merit order of gas power will not change, even with large variations in the LNG price. This is no surprise considering the widely spaced merit order between coal, gas and diesel.

Fig. 7 - Imposing the take-or-pay constraints causes the plant to be dispatched at a constant load factor, but a premium placed on a flexible LNG supply will have no effect on the plant dispatch.

Total system cost impact

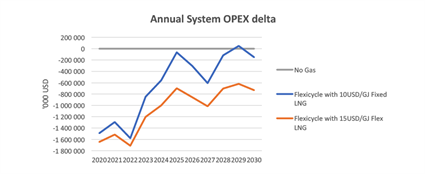

Now we examine how the system cost varies between Options A and B, when compared to the option of having no gas at all in the power system. (Figure 8)

As shown, even after applying a heavy premium for flexibility on the gas supply, providing flexible power still generates overall system savings every year. During 2020-2022, when the plant load factors are relatively closely aligned (67% and 62%), a small system savings is incurred. However, as the system demands a lower load factor from the gas plants, we see large system cost differences from paying for gas energy that is not needed. Note that, for the years 2025 and 2029, there is no benefit in having the inflexible gas solution in place at all!

Over the 10-year period, the total savings incurred by having a flexible GSA over an inflexible GSA amounts to USD 4.7 billion.

Based on this result, unless the delivered gas price is less than 7 USD/GJ, a fixed LNG supply does not make sense. Obviously, this simplistic answer does not consider indices and exchange rate risks, which are major considerations in LNG supply contracting.

Fig. 8 - Even with a 50% flexibility premium on LNG price, the system always experiences cost savings from providing flexible power as the system requires.

Conclusion

Using rigorous analysis and complex power system modelling software, one can determine the true operational requirements for SA’s future gas to power opportunities. A 3 GW LNG power plant would generate high system cost savings, in excess of 250 MUSD per year, if allowed to provide a variable annual energy load factor and reserves.

Wärtsilä Flexicycle is ideally suited to satisfy these requirements due to its high efficiency and fast operational capability, enabling non-spinning regulating reserves that result in significant savings. By reducing the operating burden in a flexible manner, savings are achieved through displaced diesel generation and optimised coal-based capacity.

Two possible GSA structures, flexible or inflexible, were proposed in the model to test the LNG GSA limitations. Despite the addition of a conservative GSA flexibility premium, the system-level benefits of having a flexible solution still far outweigh the project-level cost savings with a cost-optimised GSA, and savings amount to USD 4.7 billion over a 10-year period.

Given that it is difficult to predict what future system demand/supply requirements will be, it is even more critical to adopt flexible solutions that accommodate any uncertainty, even if it means accepting flexibility premiums. As the LNG power project is there to support the power system, the systems’ requirements must take precedence over project considerations.

Recommendations for future gas-to-power IPP programmes are the following:

Power plant flexibility should form part of the evaluation criteria.

Flexible LNG contracting options should be recognised and appropriately valued.